U.S. stocks rose for a third straight day despite declining consumer confidence as investors weighed prospects regarding upcoming tariffs from President Trump. The S&P 500 increased by more than 0.1%, the Dow Jones Industrial Average ticked just above the flatline, and the Nasdaq Composite rose nearly 0.5%, bolstered by a more than 3% jump from Tesla. Uncertainty about the scope of Trump’s tariffs has investors treading carefully.

There are signs that the administration could scale back the reciprocal duties due on April 2, with President Trump indicating potential reductions. However, Trump also announced fresh tariffs on the pharmaceutical and auto sectors in the “near future” and mentioned a “secondary tariff” on countries importing oil or gas from Venezuela. Consumer confidence reported by The Conference Board fell to 92.9 in March, down from 100.1, marking the lowest level in over four years.

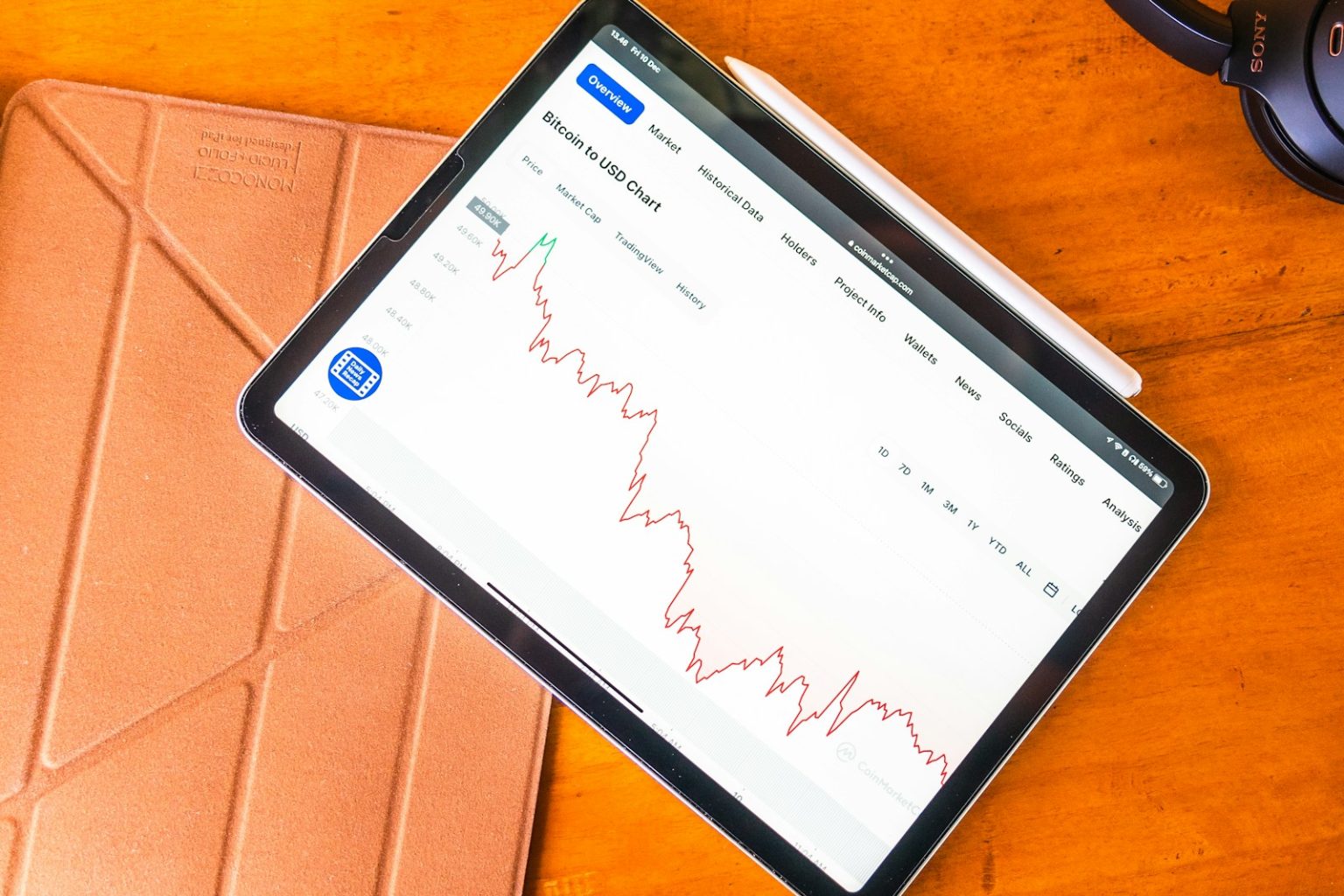

This comes as Americans express souring sentiment on the US economic outlook. GameStop stock rose more than 6% in post-market trading after the company announced it will add bitcoin as a treasury reserve asset. GameStop’s quarterly results showed net sales for the fourth quarter fell 28% year-over-year to $1.28 billion, but net income rose significantly to $131.3 million from $63.1 million the prior year.

Gary Cohn, Trump’s former top economic adviser, emphasized the need for policy certainty on a podcast, stating that “ambiguity is the No. 1 enemy of a market.” He expressed hopes for stability in US tariff policy.

Stocks rise despite tariffs uncertainty

Trump Media & Technology Group saw its stock rise 6% after announcing a partnership with Crypto.com to launch a series of ETFs, focusing on digital assets with a “Made in America” theme. Industrial metals, particularly copper, rallied close to all-time high levels due to concerns over tariffs and supply issues. Retailers are showing unease as the consumer environment worsens amid rising prices and economic uncertainty.

Shares of Netflix and Meta led the Communications Services sector higher, with Netflix stock up more than 11% year-to-date. Meta achieved an all-time high in February and remains a strong performer despite recent market corrections. Tesla’s tumbling sales in Europe have raised concerns, yet some analysts, like RBC’s Narayan, remain bullish on the stock.

Carvana stock jumped 5% after a Morgan Stanley upgrade. Analyst Adam Jonas likened Carvana’s potential to become the “Amazon of auto retail,” citing the company’s improved balance sheet and competitive advantages. Home prices continued to grow in January, albeit with signs of a slowing market ahead, while the Federal Reserve’s Kugler voiced support for keeping interest rates unchanged for some time.

Consumer confidence further tumbled in March, with economic expectations reaching a 12-year low, reflecting growing concerns about the economy and labor market. The expectations index dipped to 65.2 from 72.9, indicating potential recession risks. “Consumers’ optimism about future income has largely vanished, suggesting worries about the economy and labor market are spreading,” said Stephanie Guichard, a senior economist at The Conference Board.

Photo by; Ayadi Ghaith on Unsplash